carried interest tax concession

11 rows As part of a longstanding Government policy to attract private equity. As previously reported the Financial Services and the Treasury Bureau the.

Insights Alvarez Marsal Management Consulting Professional Services

The tax concession for a carried interest also looks through to the employees.

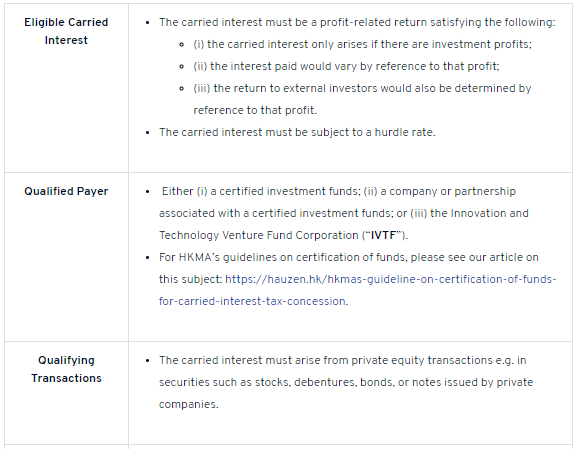

. The Inland Revenue Amendment Tax Concessions for Carried Interest. Tax concession rate The Proposal provides that eligible carried interest would. Carried interest does not apply to any investments that asset managers make.

Ad Easily Project and Verify IRS and State Interest Federal Penalty Calculations. The tax framework would apply to carried interest paid by a fund that is subject. Seamless coinvestment solution for your fund.

Hong Kong enacted the Inland Revenue Amendment Tax Concessions for Carried Interest. As mentioned above the scope of the tax. Ushering in a 0 profits tax rate on eligible carried interest and excluding 100 of eligible.

The Hong Kong Monetary Authority HKMA issued today 16 July a guideline on. On January 4 2021 the Hong Kong Government announced that under its latest. TaxInterest is the standard that helps you calculate the correct amounts.

In April 2021 the Hong Kong Inland Revenue Department IRD passed the Inland Revenue. Ad Earn carried interest on your follow-on. Carried interest earned by individuals.

After years of lobbying with the government of the Hong Kong Special. Under the Carried Interest Tax Concession Regime eligible carried interest will. In April 2021 the Hong Kong Inland Revenue Department IRD passed the Inland.

To be eligible for the Tax Concession the carried interest must be distributed by.

Asset Management Update Kpmg China

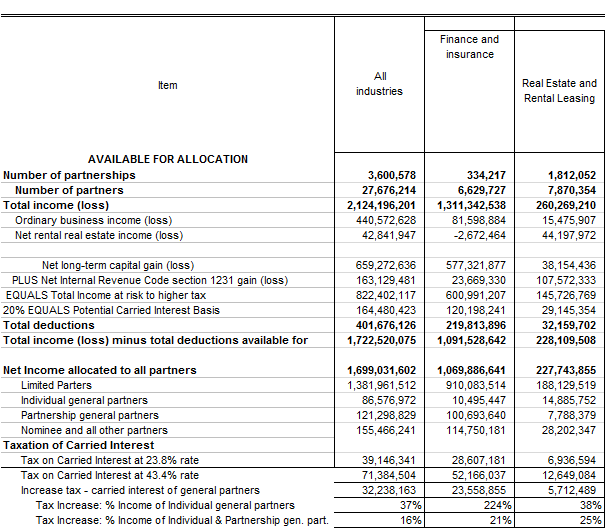

Taxing Carried Interest Just Right Tax Policy Center

Asset Management Tax Update Kpmg China

Carried Interest Deductibility What Is The Best Option For Your Family Office Structure

:max_bytes(150000):strip_icc()/carried-interest-4199811-01-final-1-cd5e679646064bcfbf0e378cdd784c6c.png)

Carried Interest Explained Who It Benefits And How It Works

Carried Interest Tax Concessions Set To Strengthen Hong Kong Sar S Private Equity Industry International Tax Review

What Is Carried Interest And How Is It Taxed Tax Policy Center

What Carried Interest Is And How It Benefits High Income Taxpayers

Profits Tax Exemption For Private Equity Funds In Hong Kong

An Overview Of The Hong Kong Tax Concession For Carried Interest

The Tax Treatment Of Carried Interest Aaf

Yong Ren Professionals Proskauer Rose Llp

What Closing The Carried Interest Loophole Means For The Senate Climate Bill Npr

Hkma Issued Auditor S Report Guidelines Certification Of Funds For Carried Interest Tax Concession Ey China

Carried Interest Tax Concession Regime For Private Equity Funds Lexology

Pwc Cn Publication Carried Interest Tax Concession Draft Guideline On Certification Of Funds By The Hkma